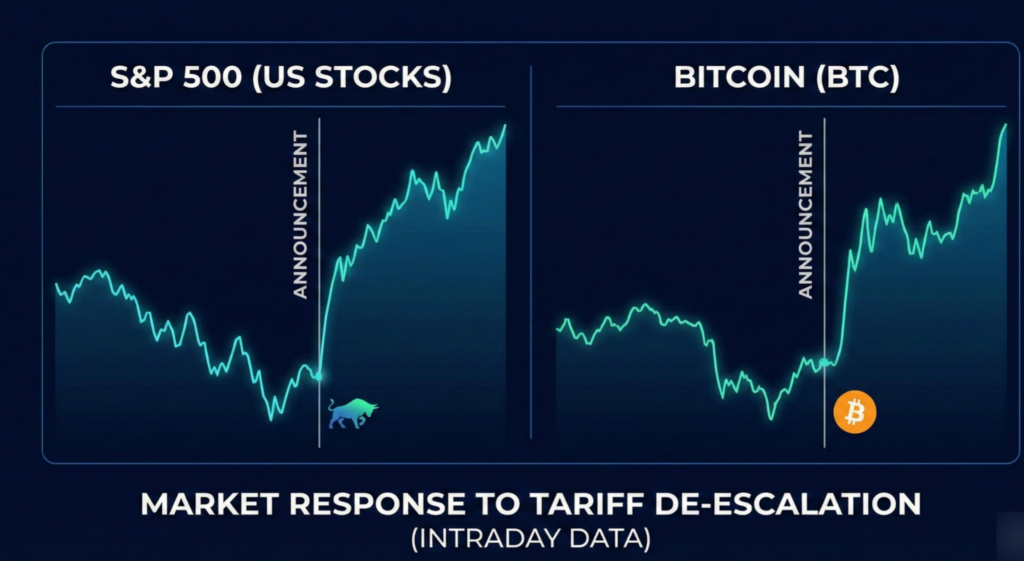

Why US Stocks and Bitcoin Surged: Trump Softened Tariff Threats

Why US Stocks and Bitcoin Surged: Trump Softened Tariff Threats. The US stock market registered a significant positive trend following former US President Donald Trump’s relaxation of threats related to tariffs. The response was swift, and this phenomenon has not been limited to stock markets only in the US or elsewhere in the world. Bitcoin and other major cryptocurrencies registered a significant boost in this scenario. Read More..

What Trump Said and Why Markets Reacted

Donald Trump has recently indicated a potential re-evaluation of aggressive tariffs levied upon major trading partners such as the European Union. Initially, in the week, there was concern based upon comments suggesting trade tension.relationcontentcontentMarket reaction was positive when Trump withdrew from the suggested tariffs. Investor confidence was aided by the alleviation of potential trade tensions among nations.

Investors hate uncertainty. More often than not, tariffs are expensive for corporations, as well as slowing down growth. Trump’s tone softened regarding trade, reducing the fear of a quick trade war. This encouraged traders to resume trade actions in more traditional assets such as stocks or cryptocurrency.

US Stock Market Gains Momentum

Major U.S. indices moved higher as investors welcomed the change in tone. Technology, manufacturing, and consumer goods stocks led the gains. These sectors usually suffer the most from trade wars, so even a hint of stability boosted confidence.

Market analysts believe that investors viewed Trump’s comments as a sign that extreme trade measures may not return anytime soon. This perception helped restore short-term optimism, especially among institutional investors who had adopted a cautious approach earlier.

The rally also reflected expectations that businesses may avoid sudden cost pressures if tariffs remain off the table. For companies already dealing with inflation and interest rate challenges, this news provided some breathing room.

Bitcoin Also Jumps — Here’s Why

Bitcoin performed well in tandem with stocks in the U.S. Traditional markets have to stabilize first to increase risk appetite among investors to be able to put their money elsewhere. This is when Bitcoin gets to benefit.

Further, some traders look to Bitcoin as a hedge against political and economic uncertainty. Such uncertainty is still a draw for a Bitcoin that is unregulated by governments. Trump’s reversal regarding tariffs alleviated short-term uncertainty but is a reminder that political changes can happen quickly.

Trading activity on the cryptocurrency markets increased as investors anticipated further inflows if sentiment remained positive. The rise of Bitcoin demonstrated that macroeconomic trends remain relevant for digital assets, despite the market’s maturity as a whole.

Investor Sentiment Shifts Toward Risk

The sum of the increase in stocks and Bitcoin reflects a change in the psychology of investors. Selling, which was driven by fear, was slowed. The interest in buying came back. Investors were attracted to the temporary openings that were created due to reduced tensions in international trade.

Yet this trend does not imply that market risks have vanished. This is especially true as Trump’s less harsh tone provides a reason for investors to re-enter the market, although only temporarily.

What This Means Going Forward

Trump’s remarks are also a reminder that he still casts a strong shadow on financial markets despite not holding any position of authority. He is capable of activating the stock market, foreign exchange, and even cryptocurrency markets based on his statement alone, without even occupying any official position.

For now, markets seem to prefer stability over drama. If Trump can maintain his non-aggressive tone when it comes to tariffs, stock markets, and Bitcoin seem likely to retain their positive trends.

Final Thoughts

The current market rally proves that political signals remain extremely influential in supporting investors’ decisions. Trump’s retreat on tariffs reduced fears, which resulted in an increase in the value of Bitcoin as well as US stocks. Although there is uncertainty, there is no doubt that investors’ confidence revives quickly once trade tensions decrease.